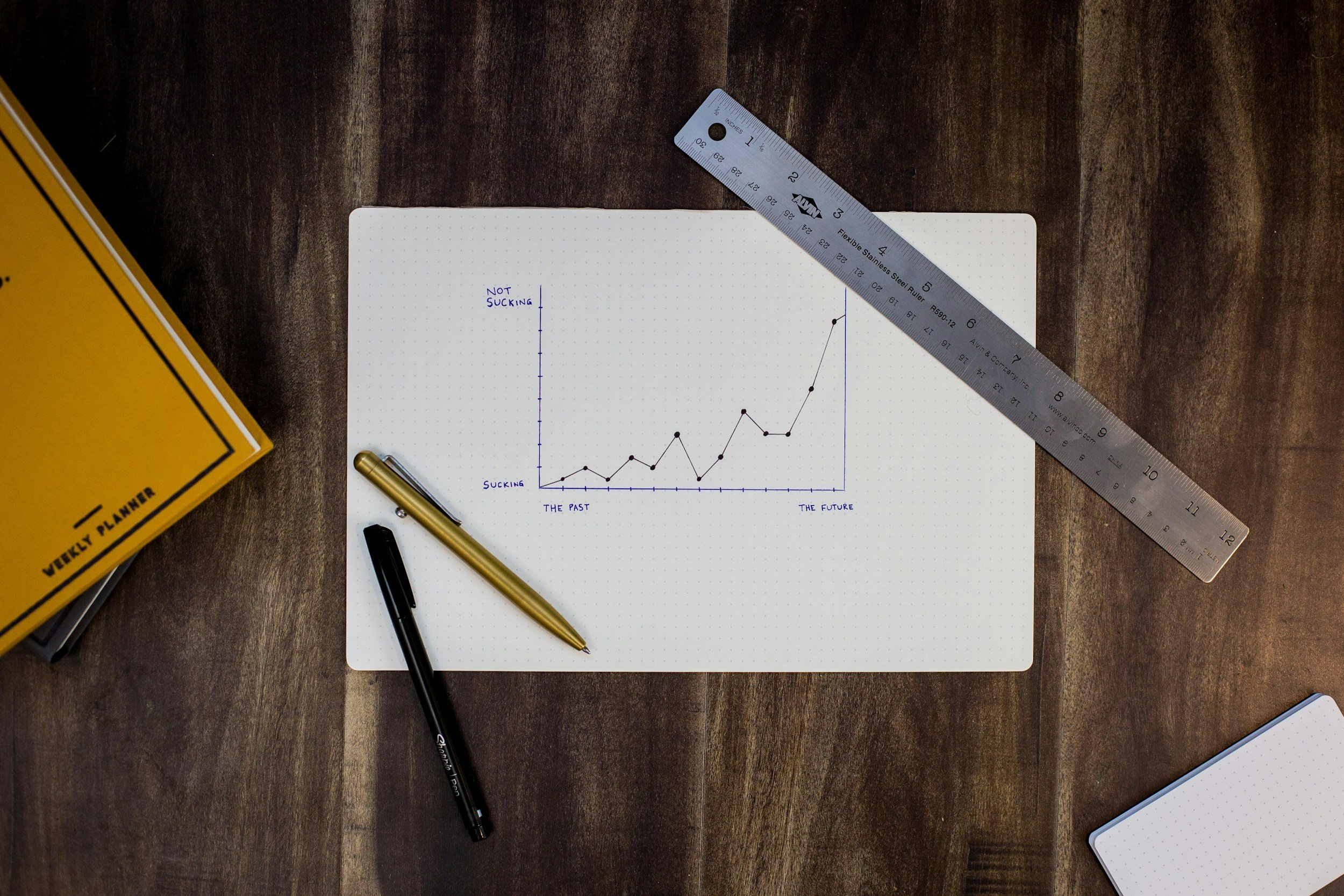

Getting a job hasn’t always been easy for me. Freezing during interviews, not being sure how to answer questions, and having my own style have all contributed in some way to making it hard for me to sell myself. A few years ago, it started getting slightly easier(still a lot to learn), but I thought I should start giving back and helping others to be better at starting, changing and improving their career/ life prospects.

As someone who has suffered and learned a lot on this journey, I will be providing you with the coaching you need to improve your life and career by helping you to identify the path that suits you best and to help you make the necessary changes to attain your goals. Many articles you read here will also include what I have learned by talking to others as they journey to a better version of themselves.

Feel free to reach out to me for a chat.

Welcome to Your Futureproofed Life.

Supporting you as you…

Start your career.

Change your career.

Make plans for business and life.